Double Materiality Analysis

The requirements established by EFRAG's new European Sustainability Reporting Standards (ESRS) have been followed, and the new Global Reporting Initiative Standards (GRI Standards) that enter into force in January 2023 were followed to determine the material issues. As BBVA Group, we identified and assessed the set of links between the company and the three pillars of sustainable development, from the perspective of the company's impacts on the environment and people through its activity – impact materiality – and the impact that the environmental and social issues have on the company's activity – financial materiality.

Issues are considered material if they have a high probability of generating a significant impact on both Garanti BBVA's financial situation and its stakeholders and the broader environment.

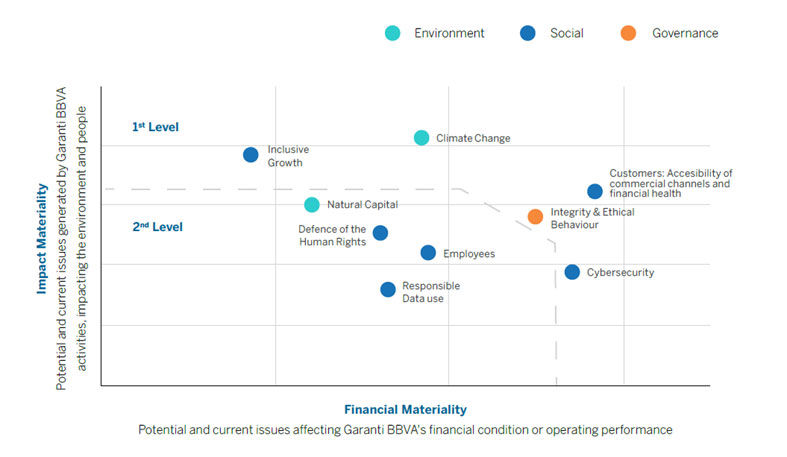

The association between potentially material issues with the analysis of impact materiality (Y axis) and financial materiality (X axis) makes it possible to sort these issues into two axes according to Garanti BBVA's impact on environmental and social issues and these issues’ impact on the Bank. This enables the Bank to identify the most relevant material issues in order to prioritize the Bank's focus and actions to tackle possible impacts or opportunities.

The assessment, conducted by the BBVA Group, is overseen by the members are from Garanti BBVA’s Investor Relations, Sustainability, Strategic Planning, Compliance, Corporate Brand Management & Marketing and Customer Experience departments. Results are presented to the bank’s Sustainability Committee for discussion and approval.

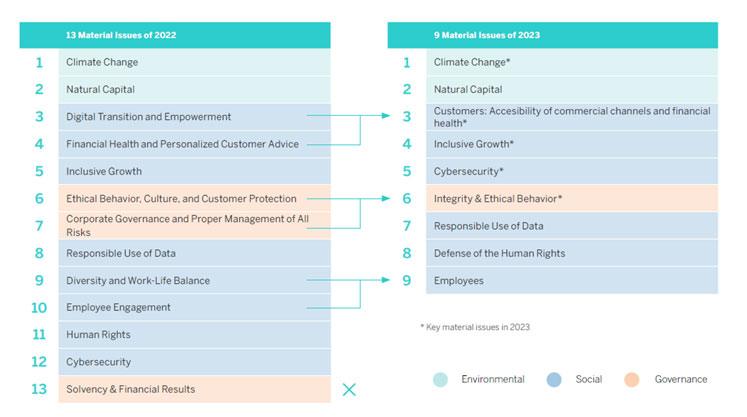

In 2023, we have identified 9 material issues, compared to 13 issues published in 2022 analysis..

- “Digital Transition and Empowerment”, and “Financial health and personalized advice to clients” are renamed and unified into a single issue as “Clients: Accessibility of commercial channels and financial health advice”. Although the issue "Corporate governance and proper management of all risks" is not separately defined as material issue, it becomes a requirement to be fulfilled by each of the material issues.

- Additionally, “Ethical behavior, culture, and customer protection," and part of the issue "Corporate governance and proper management of all risks” renamed and unified into a single issue as “Integrity and ethical behavior in business”.

- "Diversity and Work-Life Balance" and "Employee Engagement" renamed and unified into a single issue as “Employees”.

- The issue "Solvency and financial results" ceases to be classified as a material issue since it is a cross-cutting financial issue.

- to be classified as a material issue and becomes a requirement to be fulfilled by each of the material issues. In other words, each of the 9 material issues must have a governance model and proper management of all their risks, of any type.

As a result of this double materiality analysis, key material issues are:

- Climate Change: Measures aimed at adapting to the consequences of climate change, including the establishment of policies, identification and management of climate risks and opportunities, and defining decarbonization goals for the portfolio aligned with the Paris Agreement.

- Inclusive Growth: Promoting access to funding for vulnerable individuals or those with low incomes and small businesses/professionals with fewer resources and possibilities, accompanied by financial and digital education actions. Developing new products with the help of new technologies to access new markets previously inaccessible due to risk factors. Supporting governments and companies to promote employment and local development of territory and communities. Promoting society's development through philanthropic activities carried out by the company.

- Clients: Accessibility of Commercial Channels and Financial Health: Offering a good experience for all clients, ensuring the simplicity, agility, speed, and self-service of channels, while fostering innovation and digitization of services. Also, providing solutions that promote the financial health of clients, taking care of their finances and offering proposals or solutions to complex issues that require greater expertise.

- Integrity and Ethical Behavior in Business: Ensuring an environment of business integrity and ethics by complying with regulations and establishing policies, standards, internal procedures, and other control measures to prevent and manage risks related to anti-competitiveness, monopolistic practices, market abuse, corruption, bribery, and money laundering, among others. Implementing measures to identify, prevent, and manage conflicts of interest, as well as addressing the interests of clients, including transparency in client information and prevention and detection of unethical sales practices.

- Cybersecurity: Measures aimed at ensuring the security of the entity at the software and information security levels to prevent theft, attacks, or alterations of any kind that could compromise the credibility and good practices of the company.

For the objectives of key material issues for Garanti BBVA, impacting people and environment (namely Climate change and inclusive growth), please refer to the UNEP FI Responsible Banking Impact report

You may find the report here

DOUBLE MATERIALITY ANALYSIS FOR GARANTI BBVA - 2023