Garanti BBVA in Numbers

| Branch |

838 |

805 |

| Domestic |

829 |

796 |

| Abroad |

9 |

9 |

| Personnel |

18.544 |

18.965 |

| ATM |

5.450 |

5.511 |

| POS |

777.497 |

808.478 |

| Total Customer |

23.035.557 |

25.187.089 |

| Digital Banking Customer |

13.386.156 |

15.046.929 |

| Mobile Banking Customer |

13.032.549 |

14.768.620 |

| Credit Card Customer |

9.220.070 |

10.486.454 |

| Credit Cards |

12.893.009 |

15.183.137 |

| Debit Cards |

19.027.213 |

20.973.862 |

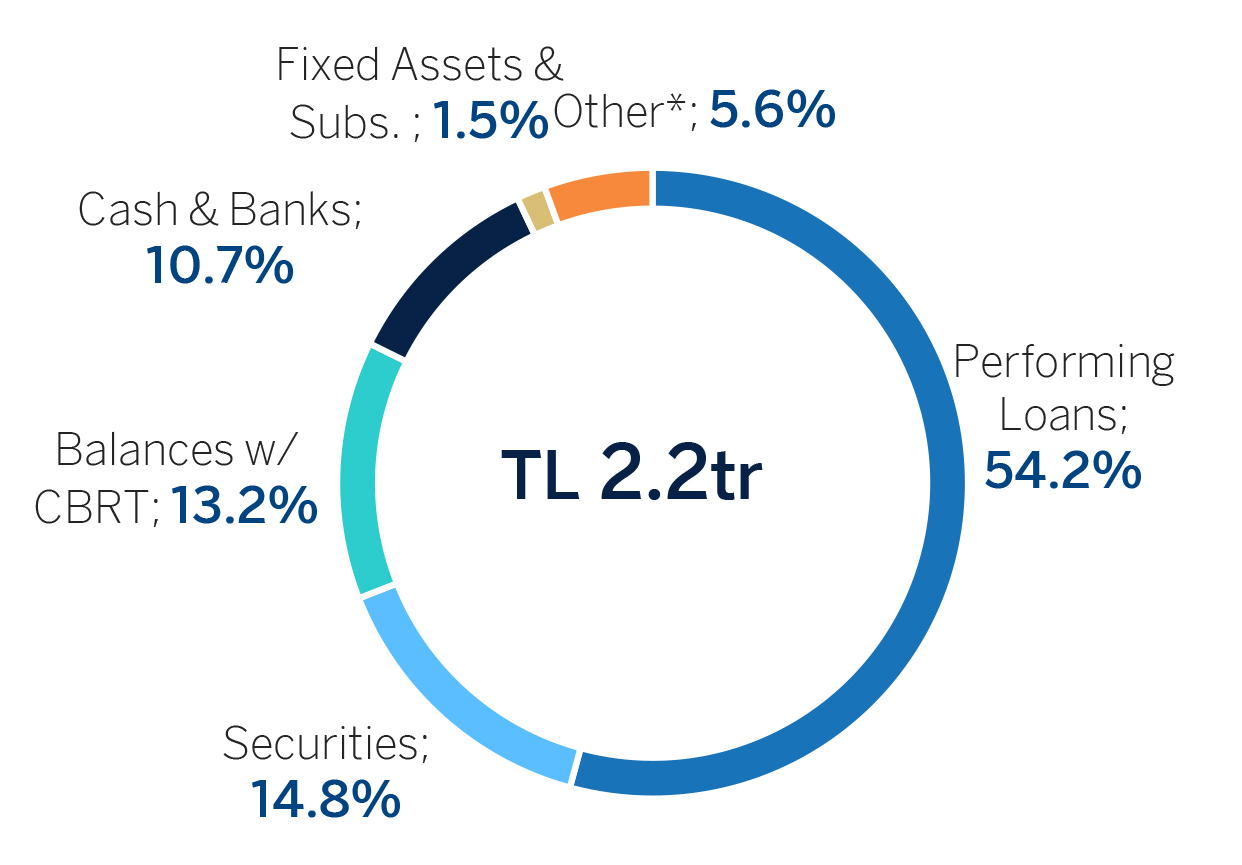

ASSET BREAKDOWN

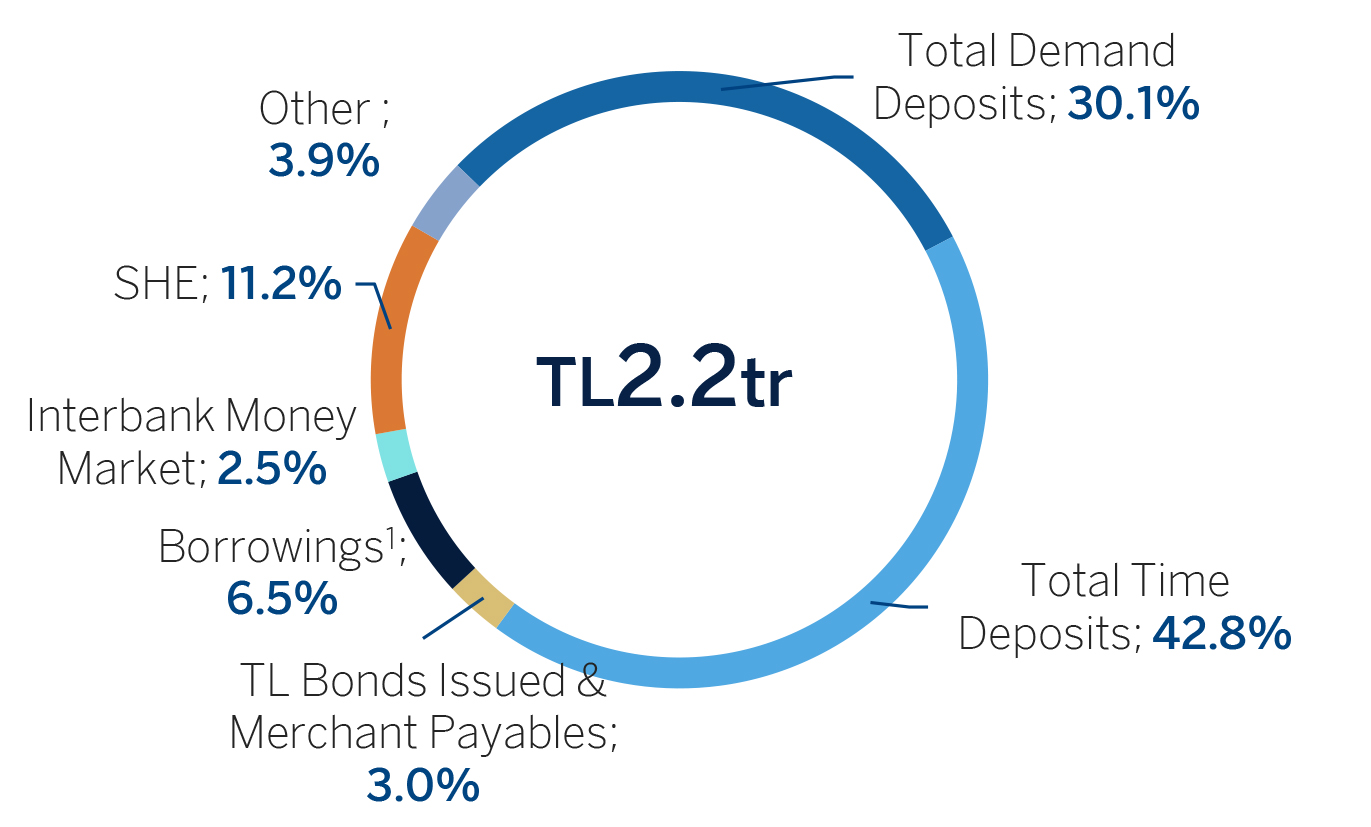

LIABILITIES & SHE BREAKDOWN

* Mainly composed of NPLs and accruals of foreign-currency protected deposits’ currency difference (TL 24bn as of Dec’2023 vs. TL 22bn as of Sept. 2023 )

1 Includes funds borrowed, sub-debt & FC securities issued.

Note: Figures are per31 December 2023 BRSA consolidated financials.

| Consumer Loans inc. Consumer CCs |

14.0% |

254 bps |

14,7% |

16,5% |

188 bps |

#1* |

| Cons. Mortgage Loans |

7,1% |

160 bps |

8,7% |

8,7% |

-8 bps |

#2* |

| Consumer Auto Loans |

15.2% |

486 bps |

15,1% |

20,0% |

495 bps |

#2* |

| Cons. General Purpose Loans |

14.1% |

85 bps |

13,2% |

14,9% |

173 bps |

#3* |

| TL Business Banking |

8.4% |

6 bps |

8,0% |

8,1% |

11 bps |

#1* |

| # of CC customers 1 |

13.6% |

-10 bps |

13,5% |

13,5% |

-6 bps |

#1 |

| Issuing Volume (Cumulative) 1 |

17.7% |

-55 bps |

17,5% |

17,2% |

-29 bps |

#1 |

| Acquiring Volume (Cumulative) 1 |

17.0% |

-123 bps |

16,9% |

16,8% |

-12 bps |

#1 |

* Rankings are among private banks as of September 2023

1 Sector figures used in market share calculations are based on bank-only BRSA weekly data as of 29.12.2023, for commercial banks

2 Cumulative figures and rankings as of December2023, as per Interbank Card Center data. Rankings areamong private banks.

| Net Interest Income |

81,097 |

| Operating Expenses |

-56,054 |

| - HR Costs |

-20,849 |

| - Other Operating Expenses |

-35,204 |

| Net Exp. Loan Loss Prov. (excl.Currency impact) 1 |

-6,171 |

| Net Fees & Commisions |

43,501 |

| NET INCOME |

86,907 |

| Return on Average Equity |

44.5% |

| Return on Average Assets |

4.9% |

| Non Performing Loans Ratio |

2.1% |

| Capital Adequacy Ratio |

16.5% |

| Net Cost of Risk1 |

0.6% |

| FEE / OPEX |

78% |

Note: Figures are per 31 December 2023BRSA Consolidated financials

1 Neutral impact at bottom line, as provisions due to currency depreciation are 100% hedged (FX gain included in Net trading income line)